The Reserve Bank of India (RBI) gives each bank branch in India a unique 11-digit code called an "Indian Financial System Code" (IFSC). This code makes it easier for banks in India to send and receive money electronically. This code is used to find out which bank and branch an account is in. It is needed for any online money transfer through the National Electronic Fund Transfer (NEFT), Real Time Gross Settlement (RTGS), and Immediate Payment Service (IMPS) methods. It is usually written on a bank check or in a passbook.

The Indian Financial System Code, or IFSC, is a code bank that their branches in India use to identify themselves. This 11-digit alphanumeric code is used to find a particular bank branch and is required for any electronic money transfer between banks in India.

How IFSC works is as follows:

1. The first four characters of the IFSC number are the bank's name. For instance, the IFSC code for HDFC Bank starts with HDFC.

2. The fifth letter is always 0 and set aside for future use.

3. The last six letters of the IFSC code tell you which bank branch you are sending money to. For example, the IFSC code for the HDFC Bank branch in Connaught Place, New Delhi, is HDFC0000003, where the last six digits reflect the branch.

4. When a customer uses NEFT, RTGS, or IMPS to send money electronically, they need to give the account number and the IFSC code of the bank branch where the money is going.

5. The bank's system uses the IFSC code to find the individual branch and help with the money transfer.

Overall, the IFSC code is very important to ensuring internet transfers of money within India go smoothly and safely.

The Indian Financial System Code, or IFSC, is an 11-digit number unique to each bank branch in India. It makes it easier for bank accounts in the same country to send and receive money electronically.

The IFSC code is essential to a bank's information because it helps identify the bank and its business when transferring money online. With the help of the IFSC number, the account's bank and branch can be found. This makes sure that the money goes to the correct version.

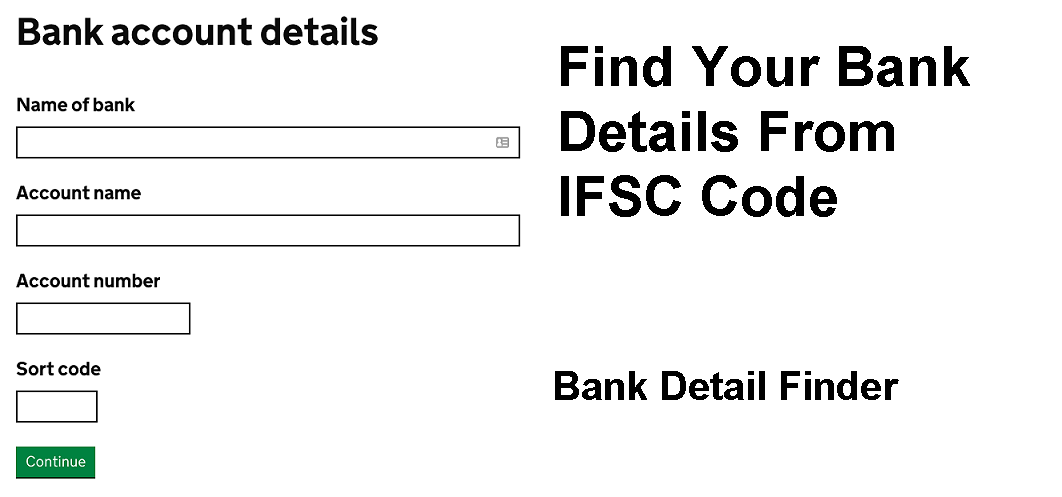

Several online tools let people look for the IFSC code of a specific bank store. Examples of such devices are the main website of the Reserve Bank of India (RBI), the National Payments Corporation of India (NPCI), and many other bank-specific websites. To get the IFSC number, the user usually has to type in the bank's name, the branch's location, and additional information.

An IFSC code of banking detail tool searches a database of all the bank offices in India that are part of the electronic fund transfer system. When a user types in the bank's name and address, the tool pulls up the IFSC code for that branch.

An IFSC code to bank information tool usually works like this:

1. In the tool's search bar, the user types in the name of the bank, the address of the branch, and other important information.

2. The tool then looks for the correct bank branch in its database.

3. Once the right bank branch is found, the tool shows the IFSC code and other information about the bank, such as the address, phone number, and branch code.

4. The person can then use this IFSC code to send money to that bank branch electronically.

5. It's important to remember that each bank branch has its own IFSC code, and even different components of the same bank may have other numbers. So, using the correct IFSC code when starting a fund transfer is essential to avoid mistakes or delays.

Follow these steps to send money from one bank account to another using the IFSC code:

1. Put in the recipient's name: Sign in to your online banking account or mobile banking app and add the person you want to send the money to as a recipient. You must give the beneficiary's name, bank account number, and IFSC code.

2. Check the facts: Check all the information you put in for the payee, especially the IFSC code, which is very important to ensure the money goes to the right account.

3. Start the transfer. Once you've added the recipient and checked the information, you can start the transfer by entering the amount you want to send and choosing the recipient.

4. Confirm the transaction: Enter your net banking or mobile banking password and finish the authentication process to confirm the transaction.

5. Wait for the transfer. Depending on the type of transfer and the banks involved, the transfer could take anywhere from a few minutes to a few hours.

By doing these things, you can use the IFSC code of a bank account to send money safely and easily. Ensuring you've entered the right information is important to keep the deal from going wrong.