Introduction To Tesla

American entrepreneurs Martin Eberhard and Marc Tarpenning started Tesla, Inc., an electric car (EV) and clean energy company, in 2003. But it is best known for its co-founder and CEO, Elon Musk, who joined the company shortly after it started. Tesla has become one of the most important companies in the auto business. It is known for its innovative electric cars, advanced energy solutions, and new ways of thinking about transportation.

Tesla's main goal is to make electric cars that are environmentally friendly, fast, and have the latest technology. The Tesla Roadster, the company's first production car, came out in 2008. It quickly got a lot of attention for its long range and fast speeds, which went against the idea that electric cars were slow and had short ranges. Since then, Tesla has added the Model S, Model 3, Model X, and Model Y to its lineup of cars to meet the needs of different market segments and customer preferences.

One of the things that makes Tesla's cars stand out is their electric engine, which lets you drive with no pollution and in peace. Tesla cars also have advanced autonomous driving features. These features, like Autopilot, use a mix of sensors, cameras, and artificial intelligence to help the driver steer, change lanes, and park. Tesla's focus on cutting-edge technology and software changes has helped them add new features and improve over time. This has made their cars very popular among tech fans and people who care about the environment.

Tesla has done a lot to promote green energy options in addition to making electric cars. The company makes energy storage goods like the Powerwall and Powerpack, which are made to store electricity from renewable sources like solar and wind. Tesla's energy products let homes and companies use clean energy and depend less on the traditional power grid.

Tesla has had a big effect on the auto business and on how people think about electric cars. The company's success has led other automakers to invest more money into electric car technology. This has sped up the move toward more environmentally friendly transportation worldwide. Tesla's dedication to innovation, technological progress, and protecting the environment has made it a leader in the clean energy revolution, and its goal is to speed up the world's move to sustainable energy.

Tesla Stocks

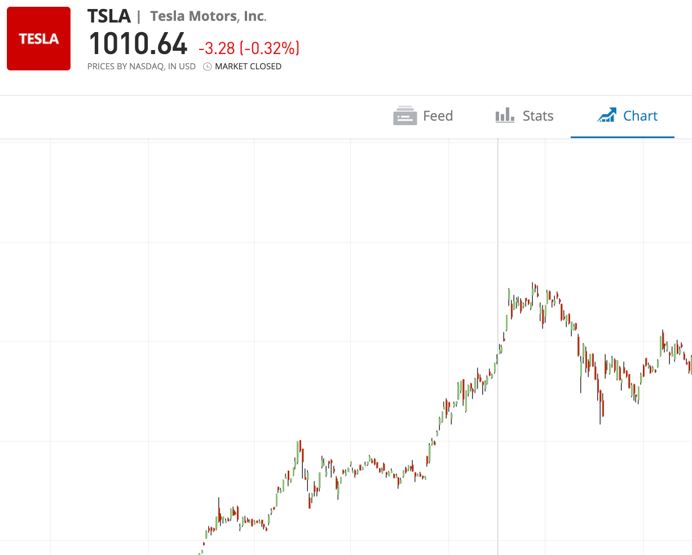

The stock symbol for Tesla is "TSLA," and it trades on the NASDAQ stock market. Over the years, Tesla's stock has been very volatile, with times when it went up quickly and when it went down. The innovative goods, strong brand recognition, and charismatic leadership of Elon Musk have interested investors in the stock.

It's important to remember that buying in stocks comes with risks, and the value of a stock can change depending on things like how well the company is doing, how the market is doing, industry trends, and how investors feel. Before making any investment decisions, it's important to carefully think about your financial goals, how comfortable you are with risk, and to study.

Check reputable financial websites or talk to a financial professional who can give you help based on your specific situation for the most up-to-date information on Tesla's stock.

Tesla Stock's Performance

In the years before, Tesla's stock (TSLA) had grown and done well in a big way. Since its first public offering (IPO) in 2010, the price of Tesla's stock has undergone many changes.

Early on, Tesla's stock price wasn't very high, but around 2013, as the company started selling its Model S electric sedan and showed that it could make more cars, the price started to rise. In the following years, the stock's performance improved as demand for Tesla's cars grew, the company moved into new markets, and investors became more optimistic.

Along the way, Tesla's stock reached several important points. The stock split 5-for-1 in 2020 means that for every share an owner owned, they got four more shares. Stock splits try to make individual shares more available to a wider range of investors.

Why invest in Tesla?

Investing in Tesla can be appealing for several reasons:

1. Market Leadership and Disruption: Tesla is the leader in the market for electric vehicles (EVs), and it has been a big part of getting the world to move toward more environmentally friendly transportation. The company's innovative and technologically advanced cars have changed how people think about electric vehicles (EVs) and given traditional automakers a run for their money. You can participate in the growth of a company that is changing an entire business by investing in Tesla.

2. Strong Brand and Demand from Customers: Tesla has built a strong brand, and its customers love it. The company's cars are known for their speed, range, and cutting-edge features. Tesla has built a loyal customer base and kept its goods in high demand by emphasizing quality and the customer experience.

3. Opportunities for growth and expansion: Tesla keeps adding new models and joining new markets to its product line. The company wants to increase its ability to make things and build more Gigafactories worldwide. As Tesla grows its market share and production ability, it has more chances to grow and get a bigger market share.

4. Sustainable Energy Solutions: Tesla doesn't just make cars; it also works on ways to store energy and use green energy. The company makes energy storage items like the Powerwall and Powerpack, which are used to store electricity made from renewable sources. Tesla's focus on sustainability and clean energy aligns with growing environmental worries around the world, making it a good choice for investors who want to help the world.

5. Elon Musk's vision and leadership: Elon Musk is the CEO of Tesla, and he is known for having a big vision, coming up with new ideas, and being an entrepreneur. Musk has a track record of successfully shaking up several fields, such as electric cars, aerospace, and renewable energy. Potential investors might like the way he leads and thinks ahead.

It's important to remember that there are risks to buying in any company, including Tesla. Stock prices can change quickly, and many things can affect an investment's performance. Before investing, it's important to do a lot of research and determine your financial goals and how much risk you're willing to take. You should also talk to a financial advisor who can give you help based on your specific situation.

Introduction To eToro

Founded in 2007, eToro is a social trading and multi-asset brokerage tool. It has become popular because of its ease of use and its unique way of combining social networking and online trade. Users can trade stocks, cryptocurrencies, commodities, markets, and more on eToro.

One of the things that makes eToro stand out is that it lets you trade with other people. Users can talk to and learn from a big group of traders through the platform. People can watch other traders, look at their portfolios, and even copy their trades automatically. This function lets new traders learn from traders with more experience and possibly copy their success.

New and expert traders can use eToro because it is easy to use and focuses on simplicity. The site has several tools and features to help traders make smart choices. It gives you real-time market data, charts, research tools, and a full news feed to keep up with market trends.

The fact that eToro offers cryptocurrency is another thing that makes it stand out. Users can buy, sell, and trade popular digital assets like Bitcoin, Ethereum, Ripple, and more on the platform, which offers a wide range of cryptocurrencies. eToro also has a unique tool called Crypto CopyPortfolios, which makes a single investment portfolio out of several cryptocurrencies.

eToro works all over the world and is controlled by reputable financial authorities. This ensures the company follows industry standards and gives users a sense of safety and security. It lets you make deposits and withdrawals using several ways, such as bank transfers, credit/debit cards, and popular e-wallets.

How To Create an eToro Account

Follow these steps to sign up for an eToro account:

1. Visit the eToro website: Type "eToro" into the search bar of your web browser or type www.etoro.com into the URL field. This will take you to the eToro website.

2. To sign up, Click the "Join Now" or "Sign Up" button on the eToro home page. This link will take you to the page where you can sign up.

3. Give your information: Fill out the signup form with the requested information. This usually includes your full name, email address, login, and password. Make sure to protect your account with a strong password.

4. Accept the terms and conditions: Read over eToro's terms and conditions and privacy policy. If you agree, you can check the box to show that you do.

5. Verify your email address. After you send in the registration form, eToro will send a proof email to the address you gave. To prove your email address, open your inbox and click on the verification link in the email.

6. Finish your profile: Once you've confirmed your email address, you'll be asked to finish your profile. This means giving more personal information, like your birth date, address, and phone number. You might also be asked questions about your trade experience and what you want to do with your money.

7. Account verification: eToro may ask for proof of your identity to meet regulatory standards and keep your account safe. Usually, this means showing a copy of a legal ID (like a passport or driver's license) and proof of address (like a utility bill or bank statement). Follow the steps that eToro gives to finish the verification process.

8. Fund your account: You can add money once your eToro account has been set up and approved. There are many ways to pay on the site, such as bank transfers, credit/debit cards, and electronic wallets. Pick the best way for you, and then follow the steps to make a deposit.

9. Start trading: Once you have money in your eToro account, you can look around the website, check out the different financial instruments, and start trading. eToro has an easy-to-use interface, charts, tools, and other features to help you make trading choices.

It's important to know that eToro may not be available in your area or have different user requirements. Make sure to check the rules and standards that are in place in your area.

How to buy Tesla stock on eToro

Follow these steps to buy Tesla stocks on eToro:

1. Sign into your eToro account: Go to the eToro website and use your username and password to sign in.

2. Go to the "Trade Markets" area. On the eToro platform, there is a sidebar on the left side of the screen. Find where it says "Trade Markets" and click on it.

3. To look for Tesla stock, type "Tesla" or "TSLA," which is the stock code for Tesla, in the search bar at the top of the page. eToro will show you related results as you type.

4. Choose Tesla from the list of search results. When you see Tesla in the search results list, click on it to go to the page where you can trade Tesla stock.

5. Review facts about Tesla. The Tesla stock trading page includes the stock price chart, real-time quotes, and important statistics. Take a moment to review this information and learn more about how Tesla has done.

6. Open a trade: To open a trade to buy Tesla stocks, click the "Trade" button or something similar that says "Open a trade." This will open a place where you can trade.

7. Set the parameters of your trade: You can set your trade parameters in the trading window. Set the amount you want to spend on Tesla stock, choose the type of order (e.g., market or limit order), and set any other parameters you want.

8. Review and approve your trade: Double-check the details of your trade, such as the amount you invest in and the type of order you place. Take a moment to ensure everything is correct, and when you're ready, click the "Open Trade" or "Confirm" button to start your trade.

9. Track your trade: You can track it on the eToro website once it is complete. You can check on your open positions, see how your Tesla stock is doing, and set up alerts or stop-loss orders to help you handle your trade.

Remember that buying stocks comes with risks and that the value of assets can change. It's important to make choices based on good information, do thorough research, and consider your financial goals and how much risk you're willing to take. Also, please keep in mind that the available stocks may depend on where you live and what eToro has to give.

Risks of Buying Tesla Stocks

When buying Tesla or any other stock, knowing the possible risks is important. Here are some of the most important risks of getting Tesla stock:

1. Volatility: Tesla's stock has always had a lot of ups and downs. Its price can change significantly, sometimes because of how the market is doing, what's happening in the news, or how investors feel. This makes it possible for the value of your property to change quickly, which can be good or bad.

2. Market and Industry Risks: Tesla works in the car business, a competitive field with many risks. Changes in customer tastes, new competitors, changing laws, changes in the economy, and changes in technology can all affect Tesla's performance and stock price. Risks in the market and the business can affect a company's ability to make money and stay competitive.

3. Financial Performance: How well Tesla's finances are doing can affect its stock price. Production numbers, deliveries, profits, and cash flow can affect how investors feel about the company and how the market sees it. Whether Tesla's financial success goes up or down, it can affect its stock price.

4. Dependence on Elon Musk: Elon Musk, the CEO of Tesla, is a big part of the company's growth and how the market sees it. His leadership has been a big part of Tesla's growth, but his actions and words can make the company more volatile and risky. Events like Musk's tweets or personal issues could affect the price of Tesla's stock and how confident investors are in the company.

5. Regulatory and political factors: Because Tesla is in the car and energy industries, it has to follow the rules and policies that govern those fields. Changes in government rules, grants, tax breaks, or trade policies can affect how Tesla works and how well it does financially. Some risks could affect Tesla's stock price from political instability and geopolitical issues.

6. Tesla has to compete: Tesla has to compete with traditional automakers and new companies that make electric cars. Increased competition could hurt Tesla's market share, ability to set prices, and ability to make money. Tesla's stock depends on how well it can keep its technology edge and fight off competitors.

7. General Market Conditions: Interest rates, macroeconomic trends, and investor opinion can all affect the price of Tesla stock. During market downturns or economic uncertainty, stock prices, including Tesla's, can go down across the board.

It's important to remember that the above risks are not the only ones. Other Tesla-specific or market-wide factors may also affect how well the stock does. When investing, studying, diversifying your portfolio, thinking about your financial goals and how much risk you're willing to take, and talking to a financial expert is important.

Conclusion

Buying Tesla stocks could allow you to grow your money and be part of the electric car revolution. The innovative products, strong brand recognition, and visionary guidance of Elon Musk have helped Tesla become its market leader today. But knowing the risks of buying Tesla or any other stock is important.

Tesla's stock has high volatility, which means that its price can change a lot. The price of Tesla's stock can be affected by market conditions, industry risks, financial success, regulatory factors, competition, and the mood of the market as a whole. Before making investment decisions, it's important to consider these risks and study them carefully.

Also, some risks come with buying stocks, and the value of investments can go up or down. It's important to have a diversified portfolio and a long-term investment plan and to talk to a financial professional who can advise you based on your situation.